Hey Everyone!

In the first part of this series, I talked about money and how to be better at saving it so that it can benefit you instead of harming you.

The Second Part of series is all about what you can to after you have established some credit (even before) as a function of Building Wealth.

Before you go another further with this bog post.

I wrote it in 2012. I decided not to edit it. I believe the content is evergreen.

*written in 2012*

Hey There! A few days ago, I posted 2 possible topics for this blog post on my facebook Fan page and the response, from those who commented, was a resounding “YES!” to a blog post about Credit and how to use it to build wealth. I realize I can talk for days about the different factors you need to consider when building your own personal fortune so I decided to break the topics up for brevity and also to deliver my thoughts to you in a manner that is both fun and very easy to follow. So, this will be a series. One that you can come back and reference as often as you wish. The Second Part of series will be what to do with the credit that you have earned as a function of Building Wealth. But this First series is all about Credit. So Let’s get into it.

Credit.That 6 letter word that will forever be apart of your financial story here in the United States. It can do so much good in your life and it can also do lots of harm if not handled with care. So How do you even get it in the first place? When I was a sophomore in College I decided I wanted to get my first credit card to purchase some books for myself instead of burdening my parents. This is how most of the conversations went when I applied for credit cards with banks:

- Bank: “Ms. Ameen, unfortunately your application has been denied”

- Me: *wiping tears away* Why?

- Bank: “Ms. Ameen, your application was denied due to your lack of credit history.

- Me: I know, I don’t have any credit! that is why I am applying for one; in order to start building credit.

- Bank: “Ms. Ameen, we wish you the best of luck in your future endeavors, is there anything else we can help you with?”

- Me: This is crazy! I will never get credit then.

You see, It’s the ultimate catch 22. It’s like your first job. You cannot get one until you have something on your resume to show that you’ve been able to sustain one before and the experience went well. So, whomever will give you that first job (or credit card) is taking a huge risk because there is not real information they can use to determine your job eligibility (in the case of credit, your credit worthiness). Lenders of credit want to know whether they can trust you with the money they are loaning you and they use all kinds of tools to make their decisions about whether or not to fork over the Owo, Dinero, Cash Money, Moolah, Doll-ahs, Cheddah to you.

With that said, obtaining credit can be an extremely frustrating process. After been turned away so many times, Here is what I did. I approached my Mom and Dad, who I knew had credit cards (and good credit), and asked them to list me as an authorized user on their account. That worked quite well, because I got my own credit card with my name on it. (Yes! My Name Ms. Ameen on a Credit-frigging-Card).

BUT, when you are just an authorized user, you have to be careful. Ultimately, it’s their account and NOT yours. You get your own card but the actual account is not in your name. So you need to ask for statements with your name on the account listed as an authorized user. This will help you when you want to show banks that you can pay bills on time. slowly, you will start to build credit (history). If you don’t want to make trouble for your co-signer, make sure to pay all of your bills on time as lack of doing so, will harm your co-signers credit.

About a year later, I was ready to be on my own and apply for credit cards again. I always wanted an American Express Card. The shiny Gold one. So I went for that first. Don’t ask me why. I used to think it was the card of the elite. The card of the “who’s who” NOT. Anyways, they denied me. lol. Amex said that although I have started to build credit, it wasn’t long enough.

I went back to my bank. I went in person and I basically begged them for the chance to have a credit card with them. I also pointed their attention to my bank account to remind them of how much I had saved with them since I started college. They took my SS# and other pieces of information and put through an application for me. They told me that they would get back to me in a few days in writing. In the mail, about 5 days later, I got my first Credit Card (MasterCard) with a $200 credit limit. That was my Credit worthiness. 200 bucks. Beggars can’t be choosy right?

Well, that card now has a limit in the tens of Thousands.

So now that you have a credit card with a high spending limit? What does that mean for you? or to your creditors? IT MEANS A WHOLE LOT for your CREDIT SCORE.

Your credit score is a three-digit number from 350 (worst) -850 (best) that tells lenders so much about your financial status/ability. Your score is used by lenders to determine your creditworthiness, or the likelihood that you’ll pay your debts in a timely manner. Whenever you apply for credit, such as a credit card or a home mortgage, a lender will use your score to decide whether or not to approve you for that credit or for the amount of that credit.

Your score changes depending on key credit-influencing actions over your lifetime of credit history. The actual score can differ (20-50 points) depending on which credit bureau (Equifax, Experian, or TransUnion) is pulling your information and what kind of credit score model is used.

There are several key factors of your credit score that are similar across all credit models. Here are some of the most popular/important factors that may impact your credit score:

- Using more than 30% of your total credit card limits

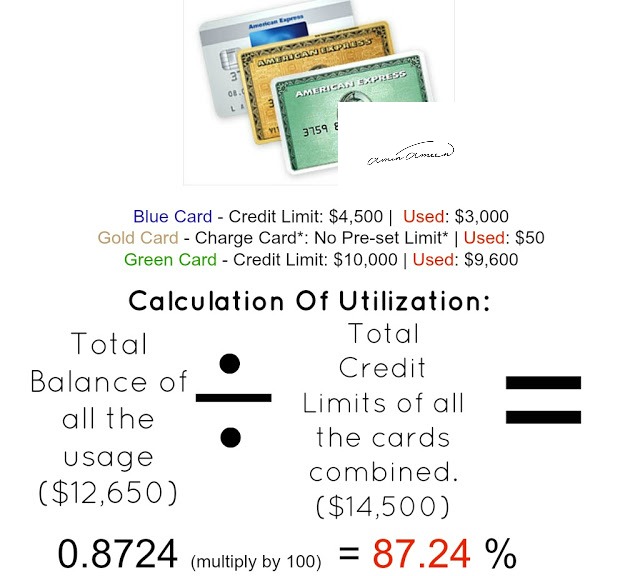

Yes, 30 is the magic number. It’s called your credit card utilization rate. The ideal number should be less than 30%. In order to calculate what your usage is, use this equation:

Take your total credit card balances (what you owe on the cards) and divide it by your total credit card limits. So for example, If I owe $12,650 on all of my credit cards, and My total credit limits on all of the cards in $14, 500, Then I am using over 87% of all of my available credit. Well above that magic 30%. Having a healthy credit card utilization rate of 30% or less communicates to lenders that you don’t pose a high credit risk and use credit responsibly. Someone who is “Maxing” out all of their credit cards has a utilization rate of %100. That is no Bueno.

If you are a visual learner like I am, and did understand anything that I just wrote above…Look at this picture. It should help. lol. (I didn’t say this stuff would be easy).

- On-Time Payments

This is another factor that can weigh heavily on your credit score. Just one or two late payments can impact your scores in a major way! No matter what I do, I try to be on time with all of my bills. Paying your bills on time is the best way to continue to grow your credit score because is displays to lenders that you are reliable and will always pay back what you owe. One late payment can potentially be credit score suicide. Literally.

If my payments are due on the 1st of the month. I usually pay the bill on the 15th of the previous month. It works out better that way. no stress. I like little to no stress.

- Derogatory Marks

I know that things may come along that will cause you to fall behind on bills etc. But take this from my experience. I got a collection placed on my credit report because I never returned a book back to my public library when I was in the 12th grade. who knew! well, it wasn’t fun waiting for that to come off of my credit report. It was a terrible blemish for something so trivial. Derogatory marks on your credit report include collections, bankruptcies, and liens. They can take 7 to 10 years to clear from your credit history, so try and be very diligent and avoid these issues when/if you can.

- Whatever you do, DO NOT close your old credit card accounts.

Many different financial analysts on debt and other financial topics have their thoughts on closing or leaving credit cards open. If you understand how credit works, you might want to keep them open. The older your credit history, the more accurate an assessment of your creditworthiness over time. The more history you have for creditors to review, the better the picture they get of you and your credit worthiness when they see that you have managed your credit over a long period of time. Also, whenever you close an old credit card account, it usually results in a drop in your credit score which is not what you should be looking to do.

Here are some other things to remember when it comes to credit. Many people say that you should not have more than one credit card. I don’t think it matters so long as you are not late with any of them and they are in good standing. One thing I will say is… try and have different types of credit. for example: I have 3 credit cards (not counting my J.crew store card). One is from my bank (the first one I opened up). 2 are from Amex (A charge card and a credit card). All of them are diverse and are used differently. My score has been positively affected by having these cards and paying on time.

Bottom line is, you want to show creditors that you can handle different types of credit accounts and that you can manage them responsibly.

Remember that credit can be a useful tool, but it can also get you in trouble. After you build credit, you may be inundated with offers. Banks, credit card companies, and others will want to loan you money because they’ll know you’re a good borrower. After you build credit, you need to continually monitor it. The US Government requires the three credit bureaus to provide a free credit report to you annually, and you should take advantage of that. Do you remember that commercial where the guy is singing the “free credit score” theme song? Yeah, legally, you are entitled to one free report per year. awesome right? Have you checked your report or score recently??

You should check it out so that you know where you stand. and once you know where you stand, you will know which steps to take next.

Let’s stay credit -savvy together! How do you manage your own credit? What credit basics do you want to know more about? What are you changing/doing in 2018 to better understand and manage your credit? Let me know in the comments below!

Also, If you have any questions, let me know in the comment section below!

It’s an Art.

#EverythingNaArt